Breaking the mould: challenging the accepted truths of financial services

This was the theme of the day at the lang cat’s recent Home Truths event in the beautiful setting of the Royal Institute of British Architects (RIBA) in London. Around 200 financial advice professionals gathered in person with more than another two hundred and fifty joining online to hear their peers challenge and defend five accepted truths, pillars on which much of the day-to-day advice business rest.

As a digital first platform we took great pleasure in getting involved as streaming sponsor. The whole day is now available as a series of videos which you can access using the various links in this article. The videos are also available on our YouTube channel.

The five pillars

- Centralised Investment Propositions (CIPs) mean consistent and repeatable outcomes

- Advisers as platform is the future

- Free choice is better than restriction

- The advice sector is sustainably successful

- Advice is changing from traditional to behavioural

What made the lang cat’s event stand out was the lack of providers on the stage. The vast majority of those engaging in the debate were advisers and planners from different types and sizes of business, sharing their own experience and insight with their peers to provoke, encourage constructive debate, and see if we couldn’t all look at things through a different lens.

The outcomes

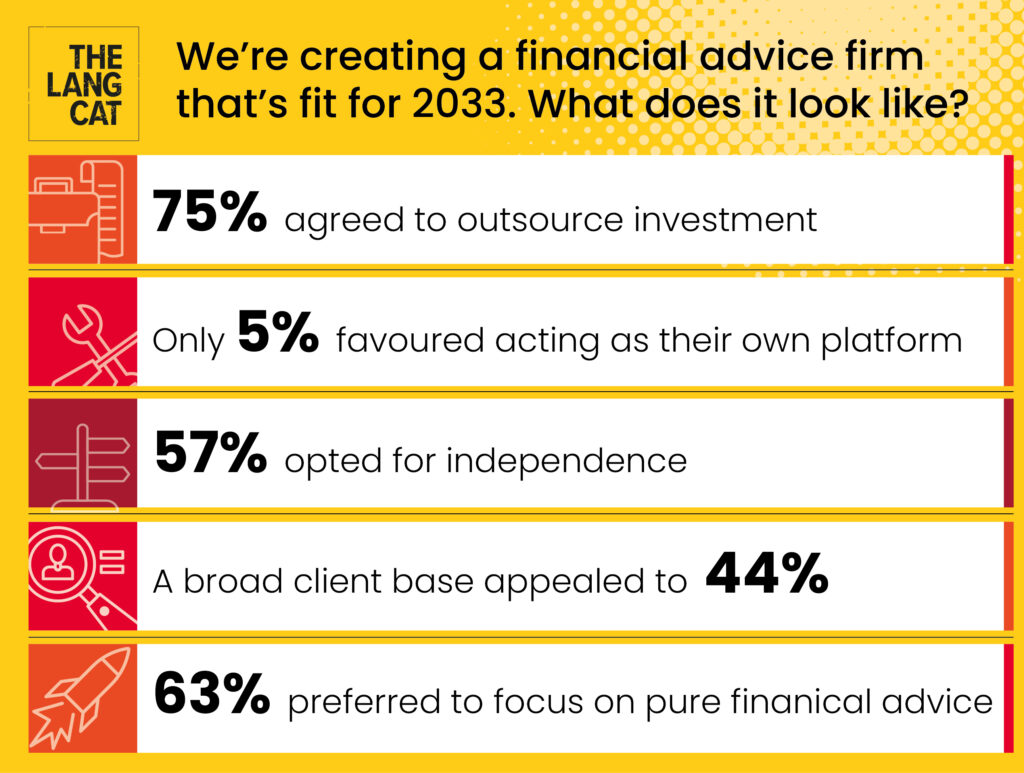

The day ended with a vote. If the financial professionals in the room were setting up a new business that would be fit for purpose in 2033, what would it look like?

It seems CIPs, or any means of outsourced investing still rule, while only the very few would be willing to take on the added risk and responsibility of acting as their own platform for the added control and potential revenue. The other quite clear result was to focus on financial advice first, with scope for softer aspects to follow. While independence won out, it wasn’t by much and a similar split was seen between taking a broad or niche approach. The lang cat’s audience tends to lean towards smaller, independent firms so some of these results were quite surprising. But that’s probably as it should be.

How we got there

The morning sessions all focused on investment. After Keith Wade, chief economist and strategist at Schroders, shared a short, sharp look at the economy and how modelling and portfolio construction are based on certain accepted truths, the first debate – between David Burridge of Paradigm Norton and the lang cat’s Mike Barrett – centred around whether centralised investment propositions (CIPs) have had their day. This was followed by a robust group discussion between Jeannie Boyle of EQ Investors, Justin King of MFP Wealth Management and Dan Williams of Morgan Williams around whether advisers also acting as investment managers was the best approach for their clients.

While the question of whether advice firms should also act as a platform ended up with one of the most decisive votes, it prompted a very balanced debate with strong, articulate arguments on both sides. Anna Pollins, MD (Partnerships) of Fairstone outlined its new Mineral offering. She stressed the importance of thinking about who you’re serving and your areas of expertise. Done properly (for business and clients) this can be a way of serving clients who are not necessarily cost effective right now but who the firm doesn’t want to turn away. They may have simpler advice needs and so not need the full offering. Philip Martin, co-founder of Nucleus and now MD of Unique Financial Planning, highlighted the risks of an advice firm setting up and operating their own platform compared to the potential rewards. Can the firm do everything and do it well? On top of running the advice business? He argued that there are better ways to invest the same spend and benefit the business.

The afternoon opened up the floor to two very different but equally engaging advice professionals. First up was Anthony Carty of Clifton Wealth, speaking in favour of a restricted approach and making the point that a lot of independent firms essentially work from a shortlist anyway. Helena Wardle shared her work with Money Means, opening up financial advice to a younger audience using subscription pricing and a digital approach. Today’s niche is arguably tomorrow’s mass market.

A more holistic approach to financial planning has become increasingly common in recent years so it was surprising to see a swing towards financial advice. How much of this was down to the philosophy of Victor Sacks, of VA Associates, is up for debate. Victor faced the ‘challenge team’ (a friendlier version of Dragons’ Den) and spoke up in favour of selling products. He believes products come first and then the ideas. Not everyone has a clear idea of where they want to get to. Products provide a structure, they can lead to the solutions clients need. Again we heard about the importance of identifying what you’re good at, focusing on that and letting other experts do what they do well in other areas. Talking and listening in the proper proportions are essential skills.

And there was certainly plenty of that in action, with debate, questions and some lively discussions both on stage and at breaks. The lang cat’s event answered its questions, raising even more in the process. What was clear however was the dedication of the advice community and their focus on doing the best for their clients, even if they might disagree on exactly what that looks like.